are hearing aids tax deductible in 2020

Deducting the cost of hearing aids from your taxable income can lower the amount you pay for hearing aids by as much as 35 percent. According to health hearing and other sources we consulted the following applies to hearing aid deductibles for the 2020 tax season.

Are Medical Expenses Tax Deductible

Hearing aids on average cost between about 1000 and 4000.

. In addition to the Medicare tax credit you can also claim hearing aids as tax deductions. At Least Hearing Aids Are Partly Tax Deductible According to Health Hearing and other sources we consulted the. This includes people earning 84000 as a single person or.

While this puts hearing aids beyond many peoples typical monthly budget there are actually quite a few ways. 104 Gilbert AZ 85234 irs letter 6419 when will i get it Call Us Today. For your hearing aids and hearing aid accessories to be tax-deductible you need to meet certain criteria.

For example you would use this line if you purchased hearing aids for your spouse at some point in 2020. One of those deductions that. Summary The IRS is the largest accounting and tax-collection organization in the world with in excess of 480 forms.

The IRS classifies hearing aids as a medical expense falling under the medical and dental expenses tax deduction. In many cases hearing aids are tax-deductible. As of mid-2020 there are no tax credits for hearing aids.

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct. The cost of hearing aids is often seen as a barrier for many who could benefit from owning one. By Joe Griffith Published July 1 2020.

Are Hearing Aids Tax Deductible In 2020. In some cases you can even claim up to 500 of hearing aids as a medical. With filing deadlines quickly approaching you should be gathering all the information and receipts for your deductions.

Rainbow Desert Inn 3120 S Rainbow Blvd Ste 202 Las Vegas Nevada 89146 702-997-2964 Henderson 2642 W Horizon Ridge Ste A11 Henderson. Only medically required equipment is eligible to be deducted. Unfortunately it seems uncommon knowledge that the IRS will allow tax.

By deducting the cost of hearing aids from their taxable. 502 Medical and Dental Expenses. You would claim the amount in this section to get the proper tax.

Polite quotes for whatsapp. In order to deduct your hearing aids you generally need. As of mid-2020 there are no tax credits for hearing aids.

After 2018 the floor returns to 10. As of mid-2020 there are no tax credits for hearing aids. You can only claim expenses that you paid during the tax year and you can only deduct medical expenses that exceed 75 of.

Deducting Medical Expenses For 2019 And Beyond

Are Medical Expenses Tax Deductible Turbotax Tax Tips Videos

Are Hearing Aids Tax Deductible Anderson Audiology

Topic No 502 Medical And Dental Expenses Internal Revenue Service

How Much Do Hearing Aids Cost Goodrx

Who Is Eligible For Hearing Aids From The Va Military Com

Audiologist Answers Questions About Medicare And Hearing Aids Coverage

Get To Know The Hear The World Foundation Hear The World Foundation

Hearing Aid Prices How Much Do Hearing Aids Cost In 2022

What Students Need To Know About Filing Taxes This Year Money

Are Hearing Aids Tax Deductible What You Should Know

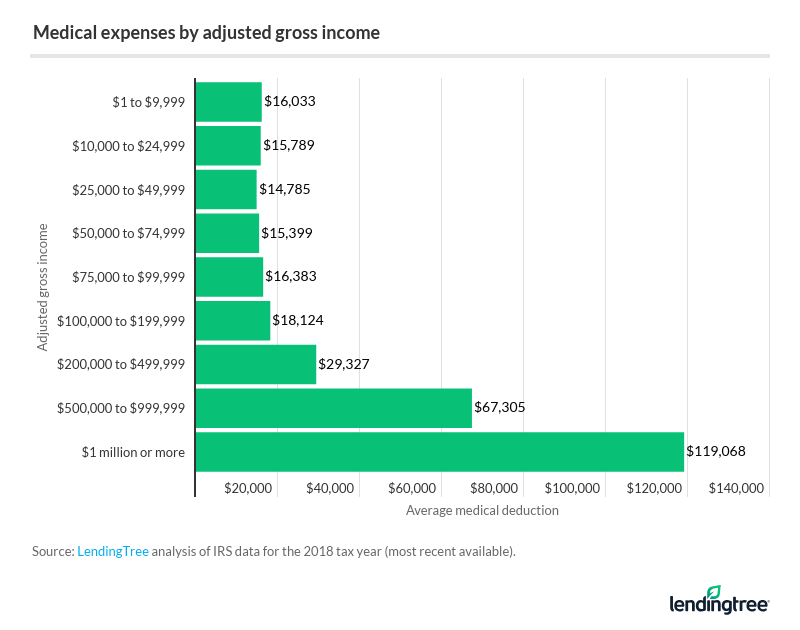

Taxpayers Claim Nearly 17 000 Per Year In Medical Expenses

How Can I Cover Hearing Aid Expenses

Are Hearing Aids Tax Deductible Anderson Audiology

The Cost Of Hearing Aids In 2022 What You Need To Know

The Cost Of Hearing Aids In 2022 What You Need To Know

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Are Hearing Aids Tax Deductible In Canada Nexgen Hearing Clinics

Great News For Tax Season Your Hearing Aids Are Deductible Hearing Associates Of Northern Virginia